Blog

What more can we say?

Just when you thought you had heard it all.

At Partners in Financial Planning, our passion for financial planning shows. From IRAs to Roth Conversions to where to volunteer, we share information on topics to help you on your financial wellness journey and more.

Client Story Series Part 1: South Dakota Adventure

We’re excited to launch our travel and adventure story series by spotlighting one of our own team members.

Love and Money in Retirement: Financial Communication Strategies for Couples

Money conversations aren't exactly known for being romantic. But for couples entering or enjoying retirement, learning to talk openly about finances might be one of the most loving things you can do for your relationship.

Charleston’s Changing Climate: How Rising Sea Levels Impact Your Real Estate Investment Strategy

Charleston is one of the most beautiful and fast-growing places in the country, but it is no secret that the metro area’s relationship with water is changing quickly. If you are thinking about buying a home here, or already own one, understanding how sea level rise, flooding, and insurance changes intersect is absolutely essential. This is not fear-mongering. It is a practical guide to what the data shows and what…

2026 Tax Changes Simplified: What the New Year Means for Your Retirement Strategy

Key Takeaways The One Big Beautiful Bill Act made most TCJA individual tax provisions permanent, so the current seven-bracket system (10%–37%) remains in place for 2026 with IRS inflation adjustments. Retirement contribution limits increased for 2026:• 401(k)/403(b)/457: $24,500• IRA: $7,500• Catch-up (50+): $8,000• Super catch-up for ages 60–63: up to $11,250 High earners with prior-year wages above the indexed ~$150,000 threshold must make all catch-up contributions as Roth starting in…

Winter in Charleston: Active Retirement Activities that Won’t Break the Bank

Here's your guide to making the most of Charleston's winter without breaking the bank.

2026 Financial Planning Resolutions: Setting Yourself Up for Success

For retirees and those approaching retirement, financial resolutions take on a distinctly different form than those of younger adults.

Holiday Spending in Retirement: Maintaining Generosity Without Derailing Your Budget

You don't have to choose between celebrating the season and protecting your retirement security.

Federal Government Shutdown Concerns: A Guide for Federal Employees

If you’re a federal employee facing potential shutdown uncertainty, you’re likely feeling anxious about your financial stability. These situations can feel overwhelming, but there are concrete steps you can take to navigate this challenging time. Acknowledge Your Concerns First, know that your concerns are valid. The uncertainty of when paychecks will arrive and how long a shutdown might last creates real stress. You’re not overreacting by wanting to prepare and…

What the Fed’s October Rate Cut Means for Your Financial Planning

The Federal Reserve cut interest rates by a quarter percentage point in October 2025, lowering the federal funds rate to 3.75%–4.0%. While this marks the second cut this year, what does it really mean for your financial planning? Understanding the Decision The Federal Open Market Committee made this move primarily due to concerns about a slowing labor market and broader economic headwinds. They also reduced the interest rate paid on…

How to Talk Money With Aging Parents

With the right approach, these conversations can strengthen your relationship while providing the peace of mind everyone deserves.

Year-End Tax Planning Strategies for High-Earning Healthcare Professionals

As another year draws to a close, healthcare professionals face a unique opportunity—and challenge—when it comes to tax planning. Between high marginal tax brackets, complex compensation structures, and multiple income streams from practice ownership, hospital employment, and consulting work, the tax landscape for physicians and other healthcare leaders can feel overwhelming. But with strategic year-end planning, you can significantly reduce your tax burden and strengthen your financial foundation as you…

Hurricane Season Aftermath: Protecting Your Financial Life from Natural Disasters

The Atlantic hurricane seasons of recent years have served as stark reminders of nature’s power and the vulnerability of our coastal communities. The 2024 season saw devastating storms including Hurricanes Beryl, Helene, and Milton—storms so impactful that their names have been permanently retired. With forecasters predicting another above-normal season for 2025, including 13 to 19 named storms and 3 to 5 major hurricanes, Southern retirees need more than just physical…

Back-to-School Season: Teaching Financial Literacy to Your College-Bound Kids

TL;DR: As your teenager heads to college, teaching them essential financial skills—budgeting, understanding credit, and making informed spending decisions—can prevent costly mistakes and set them up for lifelong financial success. As parents across the country prepare for back-to-school season, those sending children off to college face a unique challenge: ensuring their young adults possess the financial literacy skills necessary to navigate increased independence responsibly. At Partners in Financial Planning, we…

Medicare Open Enrollment 2025: What Charleston and Virginia Retirees Need to Know

TL;DR: Medicare Open Enrollment runs from October 15 to December 7, 2025, offering your annual opportunity to review and change your Medicare coverage. Understanding your options now can help you avoid costly mistakes and ensure optimal healthcare coverage for 2026. As autumn arrives in Charleston and Virginia, retirees across our communities face an important annual decision: Medicare Open Enrollment. This seven-week window presents both opportunity and complexity, as millions of…

Charitable Giving as a Family: Creating a Meaningful Summer Tradition

Charitable giving extends beyond donations, encompassing valuable lessons about financial stewardship that benefit multiple generations.

What Are Bonds, and How Are They Used? Understanding a Critical Component of Retirement Planning

Many pre-retirees understand that bonds are an important component of retirement planning, there's often confusion about what bonds are.

Time in the Market versus Timing The Market: A Critical Distinction for Retirement Success

For retirement investors, few decisions have greater long-term impact than how you respond to market volatility.

Raising Financially Savvy Children (And Grandchildren): Building Your Retirement Legacy Through Financial Education

For those nearing retirement, teaching financial literacy to children and grandchildren takes on new significance.

Mental Health in Retirement: Making a Fulfilling Lifestyle Plan

True retirement readiness encompasses not just financial security, but also a thoughtful approach to maintaining your mental health.

Tariffs: What They Are, and How They Impact Your Retirement Savings

What exactly are tariffs, and how might they affect your carefully constructed retirement strategy?

Maximizing Pension and Retirement Benefits for Richmond Healthcare Workers

Few professions require as much investment—emotionally, mentally, and especially financially—as healthcare.

Navigating Retirement Taxes in Charleston: Local Strategies for Maximizing Your Savings

We’ve rounded up all the most important facts and figures pertaining to your tax situation in Charleston.

Charleston’s Retirement Landscape: Economic Trends and Financial Opportunities

Charleston, South Carolina, has been experiencing significant shifts in its demographic and economic landscape, creating challenges and opportunities for those planning for retirement.

Understanding Property Taxes and Retirement Finances in Richmond

Property taxes are a significant consideration in overall retirement planning for many retirees and pre-retirees in Richmond, Virginia.

Balancing Retirement Savings with Current Financial Obligations: A Comprehensive Guide

Finding the right balance between retirement savings and managing day-to-day financial responsibilities is one of the most common challenges individuals at all income levels face. At Partners in Financial Planning, we understand that life’s financial demands often feel like competing priorities. This guide provides practical strategies to help you navigate these competing demands without sacrificing long-term financial security. Understanding the Retirement Savings Balance The Cost of Waiting One of the…

Investment Strategies Tailored for Richmond’s Hospital System Professionals

Healthcare professionals in Richmond’s hospital systems face unique financial challenges and opportunities. From demanding schedules that limit time for financial planning to specialized compensation structures and retirement options, medical professionals require tailored investment approaches. At Partners in Financial Planning, we understand the specific needs of Richmond’s healthcare community and have developed strategies to help you build wealth while focusing on your demanding career. Understanding the Financial Landscape for Richmond Healthcare…

Catch-Up Contributions and Retirement Savings Maximization for Pre-Retirees

If you’re age 50 or older, catch-up contributions allow you to put extra money in your retirement accounts, beyond the annual limits. The closer you get to retirement age, the more valuable those accelerated savings become. Even in your 50s, any additional contributions you make to your retirement accounts will have time to accumulate and compound before you officially retire. Some of the plans that allow catch-up contributions include: 401(k)s…

Charleston Retirement Communities: A Comprehensive Financial Guide to Choosing the Right Neighborhood

With its Southern charm, mild weather and ample opportunities for fun and leisure, Charleston is a prime option for retirees. But it’s not just the beautiful setting that makes it a top retirement destination; affordable living options, a robust healthcare system and tax benefits make it a practical choice, too. When it’s time to consider where you’ll retire, making an informed financial decision is crucial. If Charleston tops your list…

Bridging the Gap: Financial Strategies for Pre-Retirees in Their 50s and Early 60s

Let’s talk about a few common strategies we can use to help you bridge the gap and address your future income needs for retirement.

Retirement Planning for Charleston’s Coastal Lifestyle: Financial Strategies for Lowcountry Seniors

There are a few common strategies we use to help align our client's financial resources with their desires for retirement.

Celebrating 15 Years of Partners in Financial Planning: A Look Back and Ahead

Fifteen years ago, James Pearman and Pam Poldiak took a bold leap. They left a successful practice to create something entirely their own: Partners in Financial Planning (PIFP). Their vision was clear—to build a firm rooted in collaboration, exceptional service, and a deep commitment to helping clients achieve their dreams. Today, as we celebrate this milestone anniversary, we reflect on how far we’ve come and look ahead to the exciting…

Things You Can Do In Charleston South Carolina to Give Back as a Family

If you’re interested in giving back to the community, you may find it important to instill those philanthropic values in your children or grandchildren as well. Not only can working as a team help amplify your efforts, but it can strengthen your family bonds and community ties through service. For those living in Charleston, South Carolina, there’s certainly no shortage of volunteer opportunities in our city—no matter what particular cause…

Volunteerism in Retirement: Giving Time and Expertise

While retirement is an exciting phase in life where you can finally feel untethered (perhaps for the first time) from the commitment of a job, it comes with some surprising, often sneaky, challenges for older adults. Namely, finding ways to make retirement feel fulfilling while avoiding things that may threaten your happiness, like isolation and loneliness. About one-third of older adults said in a recent study that they interacted with…

Strategic Giving: Maximizing the Impact of Your Charitable Donations

In 2023, Americans gave around $557.16 billion to charity, averaging about $3,296 per donor. However, for many high-net-worth families, average donations easily exceed tens of thousands annually. If you’re inclined to start giving back—or if you’d like to increase your donations as you head toward retirement—it may be worth implementing a charitable giving strategy into your financial plan. By taking a proactive and strategic approach to charitable gifting, you can…

Retirement Savings Options for Doctors that Have Their Own Practice

Opening and successfully operating your own practice is an incredible feat you should be proud of. As you continue navigating the ups and downs of business ownership, it’s essential to keep your financial future at the forefront (though we know this can be hard to do when you’re pulled in so many different directions). Without the robust resources and framework of a hospital network to fall back on, it’s up…

A Deep Dive into 403(b)s, 457(b)s, and cash balance plans

When you hear the phrase “retirement savings account,” what comes to mind? Most people associate retirement savings with traditional 401(k) and IRAs—but those are just the tip of the iceberg. For some employees, retirement savings opportunities come in 403(b)s, 457s, cash balance plans, and other accounts. While some retirement plans share similar characteristics, plan participants should understand the unique nuances of each—contribution limits, tax treatment, required distributions, withdrawal restrictions, etc.…

Decoding Compensation Packages: A Doctor’s Guide to Salary Structures

Doctors are worth every penny they’re paid, but that doesn’t mean their salaries are simple. In fact, healthcare professionals have some of the most complex salary structures out there, which can make it difficult to navigate a new job offer or renegotiation. Yet, how you’re compensated for your hard work is a vital component of your financial health and future financial well-being. If you aren’t fully aware of your benefits…

How Carilion Clinic Employees Can Make the Most of their Retirement Benefits

DOWNLOAD GUIDE HERE Employees of the Carilion Clinic have access to relatively robust compensation packages, including retirement benefits beyond the traditional employer-sponsored 401(k). If you aren’t taking full advantage of these benefits, it may be because you don’t yet understand what is being offered and who can use it. Medical professionals face a unique challenge when preparing for retirement due to their significant student loan debt and long lead time…

Understanding Medicare and Medicaid: A Guide for Retirees

Throughout your retirement planning journey, you’ve likely heard the terms “Medicare” and “Medicaid” tossed around. While they boast similar names and can be used to help cover medical costs in retirement, they’re two very different programs—with very different features, functions, and eligibility requirements. Let’s look at what Medicare and Medicaid are and the role they may play in addressing your healthcare costs and needs throughout retirement. What Is Medicare? Medicare…

Part-Time Work and Hobbies: Balancing Leisure and Supplemental Income

Everyone’s vision for retirement is different, but now more than ever, people are looking for ways to stay active and engaged—while still enjoying the benefits of financial independence. If you’re not entirely content with the idea of sitting at home in a rocking chair during retirement, you may be intrigued by the possibility of returning to work (at least part-time) or picking up a new hobby. Both can have significant…

Longevity Planning: Ensuring Your Money Lasts Throughout Retirement

In recent decades, the average lifespan has gradually increased for both men and women. While a longer life expectancy means more time to spend with loved ones, it’s also reshaping how people approach retirement. Additional years in retirement require more savings—not to mention the increased probability of additional costs like medical emergencies or long-term care. The possibility of outlasting your retirement savings is called longevity risk, and while it sounds…

Tax-Efficient Withdrawals: Minimizing Tax Impact in Retirement

When building an effective, long-term retirement income strategy, you must preserve your hard-earned wealth. With no more steady paychecks coming your way, you and your advisor must work together to build a sustainable withdrawal strategy that protects the longevity of your portfolio while addressing your financial obligations today. Some retirees may not realize just how impactful taxes can be on the overall success of their withdrawal strategy. Your different sources…

Staying Active and Healthy in Charleston: Retirement Addition

Around 45% of retirees are considered sedentary despite the essential benefits of being active in retirement.1 Staying physically and mentally active can help you remain sharp, avoid serious injury, mitigate the risk of isolation or depression, and ward off diseases like cancer, Alzheimer’s, and heart disease. While you may not be comfortable lifting barbells or running marathons, there are plenty of fun, safe ways to get your steps in and…

Transitioning to Retirement: Phased Retirement and Succession Planning for Physicians

With long work weeks and a passion for helping others, the thought of a traditional retirement may turn some physicians off. However, leaving work behind can be more complicated than people realize, which is why adopting a phased retirement plan can be appealing. Below, we’re exploring what goes into a phased retirement and some succession planning considerations to keep in mind. What Phased Retirement Looks Like in Healthcare Let’s start…

Estate Planning 101: Helping Your Parents Secure Their Legacy

What you can do to help your parents avoid common estate planning mistakes and effectively prepare for the future.

Is It Possible to Save for Retirement While Paying Down Debt? (The Answer Is Yes!)

If you’re struggling to prioritize paying down debt and saving for retirement, here are a few tips for striking the right balance.

Debt Management in the Years Before Retirement

If you’re concerned about how your debt repayment obligations will impact your lifestyle in retirement, now’s the time to reduce.

The Credit Check: Managing Student Loan Debt and Credit Health for Physicians

Your dedication to becoming a licensed medical professional has taken you on a long, rewarding educational journey. But, as you’re all too familiar with, that journey has come at a cost. Nearly three-quarters of all medical students graduate with student loan debt—often substantial debt. Medical professionals owe, on average, $250,995.1 If you’re in the process of building a healthy financial foundation for yourself and your family but are burdened with…

Exploring Charleston’s Hidden Gems: A Retiree’s Guide

Until you visit Charleston, you don’t truly appreciate how much this city offers. If you’re thinking about relocating here in retirement, there’s no doubt you’ll find plenty of fun activities to fill your days with. To help you get a taste of what Charleston has in store, here are some of our favorite hidden gems in and around the city. The Serenity of White Point Garden If you’re already visiting…

The Role Reversal: A Guide to Navigating the Emotional Landscape of Caring for Aging Parents

We’re reviewing the emotional landscape involved with caring for aging parents and providing tips for caring for yourself and your loved ones.

Asset Protection at Charles Schwab

With the recent merger between TD Ameritrade and Charles Schwab, many of you may be asking, “are my accounts safe at Schwab?

Creating a Sustainable Withdrawal Strategy in Retirement

For decades, you’ve saved and invested diligently to fund the retirement lifestyle you’ve always dreamed of. But did you know that how you withdraw your money in retirement greatly impacts how far those savings can stretch? Some people find that developing a tax-efficient withdrawal strategy is just as (if not more) complex than building up those savings in the first place. All of this isn’t to deter you from spending…

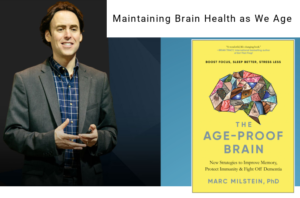

‘Age-Proof Brain 2.0’ by Dr. Marc Milstein, PhD

Dr. Marc Milstein's Virtual Event on Tuesday, February 27, 2024, at 7:00 PM.

Understanding Roth 401(k)s: A Guide for Physicians

DOWNLOAD GUIDE As a high-earning physician, you face unique hurdles when preparing for retirement. To maintain your elevated lifestyle post-working, you must establish a robust retirement income strategy and save diligently. Simply maxing out your traditional 401(k) contribution limits isn’t enough, and it doesn’t provide the attractive tax benefits of after-tax savings like a Roth IRA (which you may not be eligible to use). Enter the Roth 401(k) — a…

How Physicians Can Incorporate Charitable Giving Into Their Financial Planning

We're exploring the various ways that physicians can incorporate charitable giving into their financial life plan.

Your Personal Goals Have Changed. What Does That Mean for Your Finances?

We’re exploring the financial implications of changing personal goals and what you should do to ensure your financial life meets your needs.

Top Concerns on Southern Retirees Minds & How We’re Addressing Them

If you plan on moving to a new state in retirement, you’re certainly not alone. Plenty of retirees seek a change of pace and scenery in retirement, and the Sun Belt is a popular destination for good reason. Down in the South, we have no shortage of sunshine, warm weather, water, world-famous food, and great Southern hospitality. And while we know there are plenty of benefits to heading down south…

How You Can Financially Prepare for Natural Disasters in South Carolina

South Carolina is a gorgeous, geologically diverse state with incredible culture, food, adventure, and hospitality. Suppose you’re thinking about moving to South Carolina in retirement. In that case, however, it’s critical to consider that this southern state is situated along the coastline — making it subject to significant natural disasters. From hurricanes and flooding to heat waves and thunderstorms, Mother Nature can take a toll on those living in the…

Tips For Preventing Fraud

Our firm plays an important role in helping safeguard your assets, but you can also take action yourself to protect and help secure your information.

5 Signs You Need to Work With a Financial Planner

When do you know it’s time for you to work with a financial planner? Here are five tell-tale signs to look for.

3 Essentials Physicians Need For a Successful Investment Portfolio

Physicians face unique financial challenges. We’ve identified three essentials every physician's investment strategy needs.

The Financial Details Physicians Need to Know Before Starting a Private Practice

Around 49.1% of physicians work in private practices.1 If you’re looking to join the ranks of physicians-turned-business-owners, you have an exciting journey ahead. But much of your future success and ability to sustain a profitable practice will depend on the financial details and logistics you work through now. To help you build your to-do list and create a comprehensive plan, we’ve outlined the important financial considerations to make when starting…

Starting a New Employment Contract? The 6 Negotiation Strategies Physicians Need to Know

Receiving a new job offer is exciting, and it presents an opportunity for physicians to negotiate a better compensation package than they had before. Once the rounds of interviews are over, you may be tempted to say yes to the first offer a potential employer makes. But if you hold off on signing the offer letter, you can secure more favorable terms and set the stage for a successful professional…

Why Should You Work With a Fee-Only Financial Advisor In Retirement?

Approaching retirement, every financial decision you make matters. As you prepare to enjoy a life of financial independence, knowing you have the right partner and guide in your corner is essential. But did you know that not all financial advisors are created equal? You can learn much about their motivations, intentions, and regulatory standards based on how an advisor is compensated. Let’s look at what a “fee-only” financial advisor is…

How To Meaningfully Include Your Children In Your Estate Plan

We’re discussing why it’s essential to include your children in estate planning and how to do so effectively.

Client Appreciation Event – Salem Red Sox Game

Great turnout at the Salem Red Sox Game for our Client Appreciation Event, on Thursday July 27th, 2023.

What Is Financial Freedom?

As you move through life, your financial landscape tends to evolve. It’s natural to outgrow your previous goals and objectives, especially as your family grows and your priorities shift. For those who find themselves with more complex financial questions and challenges, our Financial Foundations service may not be enough. To help you more effectively address your financial concerns, we offer a service called Financial Freedom. It’s specifically designed for those…

Do Retirees Need Flood Insurance If They Live In Charleston, SC?

Charleston, South Carolina, is (in our humble opinion) one of the best places in the country for individuals and couples to retire to. There’s no end to the entertainment, food, culture, and outdoor adventures that await those who come to Charleston. If you want to move here, you’ll likely purchase a house or condo to call home. As you consider your options, remember that your new home could come with…

Your Parents Are Aging, Should You Move Home To Care For Them?

If you’ve noticed any cognitive or physical decline in your parents lately, you may be considering what support they’ll need. It’s common for adult children to move back home and care for their parents, especially with the recent increase in remote work. Before making any big decisions, there are some considerations to review with your parents and their (or your) financial professionals. Here are a few important talking points to…

Do Roth 401(k)s Have Income Limits? And When It Makes Sense To Contribute

There are plenty of savings vehicles designed to help wealth builders transform their earnings today into future retirement income. Each offering has advantages and considerations, making it challenging to select the right option. Should you opt for accounts that can reduce your tax obligations today or delay the tax savings for retirement? There’s no right or wrong answer when choosing retirement savings vehicles since everyone’s financial situation looks different. To…

How Fixed-Income Strategies Help You Meet Your Retirement Income Goals

With so many options available, you may wonder what the right retirement income strategy is for you. Let's look at fixed-income strategies.

You Saved So Much Money to Retire, Don’t Be Afraid to Spend It

Spending should be a rewarding and fulfilling experience. Here are a few ways to shift your mindset and prepare to spend during retirement.

How You Can Maximize Your Social Security Benefit While Still Working

Social Security is one of the cornerstones of most retirees’ income strategy in retirement. While you don’t want to rely solely on it to cover your expenses, having this fixed income can still provide peace of mind and stability during your post-working years. But did you know there are things you can do now, while you’re still working, to maximize your future benefits? The average monthly Social Security retirement benefit…

5 Questions to Ask Your VA Financial Advisor In Your Next Meeting

We’ve gathered five standard questions to help you get the most out of your relationship with your VA financial advisor.

Barks N’ Rec for Saint Francis Service Dogs

Do you run? Bike? Kayak? Can you juggle? Cartwheel? Are you great at hacky sack? Whatever you like to do for fun, do it for Saint Francis Service Dogs.

What SVB’s Collapse Means for Your Money

The good news is that most investors don’t need to be concerned.

What Is Financial Life Planning and What It Means to us at PIFP

Financial Life Planning might be a new term for you. We're sharing why we choose to approach wealth management from this unique angle.

7 Excellent Ways Gen X Can Level Up Their Money

As you continue thinking about ways to optimize your wealth before retirement, here are seven ways Gen Xers can do to level up their money.

4 Great Tax Planning Secrets High Earners Need to Know About

One of the key ways to preserve wealth is to take control of your tax liability year after year. Our tax planning secrets can help you!

How to Find the Right Financial Advisor in Charleston, SC for You

Looking for a Financial Advisor in Charleston? At first, it may seem like all advisors are created equal, but, there are many differentiators.

Dr. Marc Milstein Virtual Presentation “The Age-Proof Brain”

Maintaining Brain Health as We Age - Virtual Event Organized by PIFP

Why Timing the Market Can Hurt Your Long-Term Growth and Net Returns

Investing was designed to be a long-term strategy you can use to grow wealth, combat inflation and preserve purchasing power, save for retirement, and meet your other financial goals. As you think about your own relationship with investing, it’s helpful to consider different types of investing philosophies and decide what’s best for you and your financial life. Why Do You Invest? Some people tend to correlate the idea of “investing”…

Protecting Your Identity, Data, and Assets

It’s Not a Matter of If, but When… 17.6 million people experienced identity theft in 2014. 63% of confirmed data breaches involved weak, default, or stolen passwords. Identity fraud is a serious issue. Fraudsters have stolen $112 billion in the past six years, equating to $35,600 stolen per minute. Common Cyber Threats Email Account Takeover What is it? A cybercriminal hacks an email account and reads emails to learn about…

The Financial Foundations You Need to Build for a Bright New Year

A new year is a new opportunity for young professionals like you to start things off on the right foot. What do you want to accomplish in the next year, five years, or even 20 years down the road? While growing your wealth isn’t necessarily a goal in itself, it is a tool you can use to help achieve these grander life goals and visions for the future. By planning…

Blackwood Department of Real Estate at Virginia Tech

Seth Carter, an associate financial planner at Partners in Financial Planning, LLC, visited Professor Clements' Careers in Real Estate (1014) class on November 30th.

5 Ways Transplants Can Feel at Home in Charleston, SC

Moving is one of the top five most stressful events in a person’s life, and it certainly doesn’t get easier as you age.1 We tend to grow deep roots the more time we spend in one place, not to mention accumulate more belongings. So moving to a new city can be especially challenging for anyone nearing retirement. But the great news is Charleston is a growing community with lots of…

You’re 10 Years Away from Retirement, What Should You Do?

When you started saving for retirement, it probably felt like a million years away. But as time moves on, retirement continues to creep closer. We’re not just talking about being financially prepared for retirement. Now’s also the time to consider the lifestyle you envision. What will you do with your time every day? How will you feel fulfilled and purposeful outside of work? If you’re worried that you’re not quite…

Why It’s Important to Designate a Representative for Medicare Supplements and Social Security

It’s incredibly challenging to watch your parents age. But considering that around 53.1 million adults are caregivers in the United States, there’s a good chance you are or will be responsible for helping your aging parents.1 One thing you don’t want slipping through the cracks is Medicare bills. Unpaid premiums have the power to wreak havoc on your parents’ retirement plan. When gone unchecked, they could snowball into debt or…

How The Inflation Reduction Act Affects the Solar Tax Credit

More households across America are focusing on being environmentally conscious by changing their daily lives. In 2020, for example, solar panel use increased 43% from the previous year.1 There’s no better time to implement clean energy sources into your home than right now, especially in light of the recent Inflation Reduction Act. Solar panels provide emissions-free energy and help reduce your carbon footprint. If you’re weighing the costs and considerations…

Is Charleston, South Carolina A “Tax-Friendly” Place to Retire?

When selecting your dream retirement spot, several criteria spring to mind. For example, nice weather, lots of options for entertainment, proximity to family, possible work opportunities, and volunteer spots could be on your wish list. While that’s a great roundup, one benchmark we recommend adding to your list is “tax friendliness.” It’s not nearly as fun to think about as all the sun and fun Charleston offers, but it’s still…

How The Inflation Reduction Act Impacts The Electric Vehicle Tax Credit

Gas prices seem to have a mind of their own this year. While the Charleston, SC and Roanoke, VA areas weren’t hit the hardest, prices still rose to about $4.60 per gallon this summer.1 After months of global economic volatility impacting prices at the pumps, purchasing an electric vehicle (EV) is becoming more appealing. For example, Teslas are sleek, fun cars of the future, and even major car makers like…

Do You Have Enough Life Insurance?

September is National Life Insurance Month! To “celebrate,” we’re helping you determine if you have enough life insurance coverage to protect your family. The financial lives of medical professionals tend to be complex, and many doctors are the primary earners for their families. So, life insurance plays a vital role in protecting your family’s financial well-being in the event of an unexpected loss. Here are the top things you to…

Your Loved One Is Considering Moving Into A Retirement Community In Charleston, SC, Now What?

There may come a time when a parent, in-law, close relative, or other loved one no longer wants to live in their own home. Or, as their health declines, it becomes unsafe for them to continue living independently, making a retirement community an excellent option. Whether for personal reasons, medical concerns, or a combination, it’s essential to plan for what this next step looks like. Charleston is home to several…

3 Core Types of Equity Compensation You May Come Across As A High-Earner

Did someone say equity compensation? Equity compensation is quickly growing as a popular payment method in various industries like tech, medical, pharma, and business. As you grow in your career, you’ll likely see more equity compensation on the table. Providing equity is an excellent way for companies to reward and retain top talent. While “stock options” is often used to describe all types of equity compensation, there are several common…

The Best Volunteer Spots For Retirees This Summer In Charleston, SC

Volunteering is wonderful for so many reasons. It allows you to give back to the community, connect with a cause you’re passionate about, and make new friendships. With all the benefits, it’s no wonder retirees make volunteering a significant part of their lives. More than 60% of retirees over the age of 55 are volunteering in some capacity.1 With summer in full swing, now’s the perfect time to go outside…

3 Interesting Considerations With a 401(k) Rollover

When starting a new job, the paperwork feels never-ending. Your employer needs answers about insurance, benefits, stock options, beneficiaries, etc. Among those decisions, you likely have the chance to take automatic deductions from your paycheck for a 401(k). The great thing about this is that you’re saving for retirement without thinking about it! But at some point in your career, you may find it beneficial to move money out of…

What’s A Roth Conversion and Is It A Good Move For You?

High-earners, like most doctors, surgeons, and physicians, face an interesting conundrum when saving for retirement. They need to save more than most to maintain their lifestyle, but they can’t directly access certain savings accounts, like Roth IRAs. Roth IRAs are especially useful for young physicians earning less now than they likely will in the coming decades. But if you’re making more than $144,000 filing single ($214,000 if married, filing jointly)…

A Quick Guide To Help You Navigate Your Hospital Benefits

If you’re a physician working for a large medical system, there are likely several benefits to consider. You may not have given them much thought when signing on, but it’s essential to regularly review benefits like your retirement savings options, insurance policies, stock options, and more. Here are a few common hospital benefits to address. Retirement Most of us rely on the retirement savings plans our workplaces offer us, and…

Richfield Living 2022 Wellness Day

It was a great day at Richfield Living’s first Wellness Day event to promote their 8 pillars of wellness - Physical, Spiritual, Financial, Emotional, Vocational, Social, Intellectual and Environmental. Partners in Financial Planning was a participant with team members Stephen Bain and Seth Carter.

Top Resources To Care For Aging Parents In Charleston, SC

Around 53 million Americans have served as unpaid caregivers to an adult within the last 12 months.1 Studies have shown time and time again that caregiving can affect someone’s mental, physical, and financial health. If you’re becoming a caregiver to a loved one, there are resources available to help reduce the burden on you while getting your loved one the care they need. We understand that caregiving can be incredibly…

The PIFP Story: What It’s Like To Work With Us

We know you have so many options for working with an advisor. Thousands of firms are at your fingertips, especially in a world gone virtual. How do you even begin to choose? The relationships we develop with clients go far beyond finances. We enjoy creating deep, long-lasting connections with people who enjoy our company and trust in our advice. That’s why we wanted to share the Partners in Financial Planning…

5 Things To Know If You’re Relocating To Charleston, SC For Retirement

Charleston is rich in history, food, nature, and more. If you’re considering relocating to Charleston in retirement, it’s an incredible place to live out your golden years. But if you’re an out-of-towner, there are some things to know about South Carolina and Charleston before relocating for good. Below we’ve rounded up five top must-knows for those looking to relocate to Charleston, South Carolina in retirement. 1. South Carolina Boasts Several…

How Carilion Clinic Employees Can Make The Most of Their Retirement Benefits

If you’re an employee of Carilion Clinic, you likely have a generous compensation package. But with a complex and varied set of benefits, did you pay close attention to Carilion Clinic’s retirement offerings? Preparing for retirement starts by making the most of every benefit available. But since employees may need to “opt-in” to these benefits, you may have overlooked some during the hiring and onboarding process. Below we discuss the…

How To Build A Strong Retirement Plan As A High-Earning Physician

Physicians are some of the most disciplined and driven people in the world. You spent more years in school than most other professionals, followed by a grueling and intensive residency. Whether you’re just at the beginning of your career or looking to hang your white coat up for good, there’s never a bad time to think about your retirement plan. Just as you focus on the health of your patients,…

The Top Pros and Cons Physicians Should Know About Roth 401(k)s

As a high-earning physician, you must start preparing for financial independence retirement early in your career. The more time you give yourself to save, the less stress your transition becomes, especially if you want to maintain your current or similar lifestyle in your next step. You have numerous options for building your retirement savings. If your hospital system offers a 401(k) or 403(b), they may also allow you to utilize…

Do You Want To Switch Medical Systems? What To Evaluate Before Leaving

There are three primary medical systems in the Roanoke, VA area: the Salem Veteran Affairs Medical Center, the Carilion Clinic, and the LewisGale Medical Center. These networks are home to some of Virginia’s finest healthcare workers and have earned prestige within the healthcare community. The Partners in Financial Planning team specializes in helping physicians, doctors, surgeons, and other medical professionals navigate their employment options within these and other systems. It’s…

How New Doctors Can Navigate a Physician’s Mortgage (And Buy The Right House)

Doctors interested in purchasing their first home tend to face more hurdles than other homebuyers. Their debt-to-income (DTI) ratio is high, and being in residency may make it challenging to prove employment. These can be red flags (even deal-breakers) when trying to obtain a conventional mortgage, which is why some lenders offer loans specifically for physicians. What Is a Physician’s Loan? A physician’s loan, or doctor’s mortgage loan, is a…

Creating More Buzz for Non-Profits

Twelve non-profits have been featured on Buzz since the debut in August 2020 on Blue Ridge PBS. A look back at all the good that was buzzing around at Buzz4Good.

Benefits of Using a 529 Plan

There are multiple ways to save for your child or grandchild’s future and it’s always a great idea to start as soon as possible. Many parents choose to save by opening a savings account for them at their local bank or to simply put aside money when they can. Unfortunately with these types of savings, you’re limited to how much interest you can earn, if any.

How To Manage The Top Financial Priorities for Physicians & Medical Specialists in 2022

As a medical specialist, you’re in a unique financial position. Through your years of schooling, you’ve accumulated an extraordinary amount of student loan debt, but your earning potential is equally significant. Doctors and other healthcare professionals pay between $365,000 and $440,000 on average in student loan debt and interest.1 That’s almost 10 times the amount an average non-medical student borrows! 2 But with a high earning potential, determining the right…

Protect Yourself from Phishing

According to the FBI, more than 114,000 people fell victim to phishing schemes in 2019, collectively losing around $57 million. With the holiday season quickly approaching, phishing schemes will inevitably increase. Phishing is a method of identity theft that provokes individuals into giving up personal information. These types of schemes typically come in the form of a text, email, or website. It’s important to understand what phishing is, what it looks like, how you can be prepared for it, and what to do if you fall victim to one of these tricks.

Traditional vs. Roth IRA

market. The two most popular IRA’s are the Traditional and Roth IRA. The Traditional IRA originated in 1974, but the Roth IRA didn’t come along until 1998. Below are the key differences between the two accounts as well as how they can help you plan for retirement.

Joseph Schmidt Earns CFP® Designation

After two years of serving clients at Partners in Financial Planning, in October 2021, Joseph Schmidt completed all the necessary requirements and earned the CFP® designation.

What is a Health Savings Account (HSA)?

Costs continue to rise, these accounts are becoming increasingly popular because of their tax benefits and growth potential. Let’s look at what makes an HSA unique and how you can qualify for one.

Buzz4Good featuring Christiansburg Institute and Spectrum Media Solutions (Part 2)

Check out part 2 of the story of Christiansburg Institute and how Buzz4Good in partnership with Spectrum Media Solutions is making a difference in the community and across the nation.

Buzz4Good featuring Christiansburg Institute and Spectrum Media Solutions (Part 1)

Learn the history of Christiansburg Institute and the vision for its future, with the help of Buzz4Good and Spectrum Media Solutions.

Buzz4Good revisits Mill Mountain Zoo & Eastmont Community Foundation

Buzz4Good takes a look back at the difference made with Mill Mountain Zoo and Eastmont Community Foundation.

Buzz4Good featuring Giles County Foster Care

Giles County has a foster care crisis and Buzz4Good, with the help of 5Points Creative, stepped up to make a difference. Check out how in episode 10 of BUZZ.

Buzz4Good featuring Virginia 811

Virginia 811 is a not-for-profit organization created to protect Virginia's underground facilities. See how Buzz4Good with the help of Carrie Cousins made a difference with Virginia 811's marketing to educate and bring awareness to Virginians.

Buzz4Good featuring Feeding Southwest Virginia

Check out the latest episode of Buzz4Good sponsored in part by Partners in Financial Planning. Supporting nonprofits is just one of the ways we help give back to our local communities.

Buzz4Good Episodes 5-7

Partners in Financial Planning supports nonprofits in our communities to help make the communities a better place to live. Partnering with Michael Hemphill and Buzz4Good along with American Advertising Federation Roanoke and its members provided a synergy that produced a result greater than what each of us could have accomplished individually. See how collectively, great things are happening right here in the Roanoke Valley.

Pop-Up Food Distribution at Salem Red Sox Stadium

A heavy rain shower added some excitement to today’s Feeding Southwest Virginia Pop-Up Distribution at Salem Red Sox Stadium but the Partners’ team persevered. There was no break in the line of cars and our volunteers kept handing out the food. A personal thank you to our team members and their family members that helped make today’s distribution a success.

Buzz4Good Episodes 1-4

In addition to being a partner with our clients, Partners in Financial Planning supports nonprofits in our communities to help make the communities a better place to live. Check out four non-profits in these BUZZ episodes.

Pop-Up Food Distribution at William Fleming HS

We had a great afternoon volunteering at the Feeding Southwest Virginia Pop-up Food Distribution at William Fleming High School. We handed out boxes of non-perishable food, produce, and other staples to assure that families would have nutritious food. We’ll do it again next Friday at Salem Red Sox ballpark from 1:00 PM to 3:00 PM.

Well done is better than well said.

-Benjamin Franklin