What’s Happening

At Partners in Financial Planning, we keep you informed on a variety of topics. Check out our Blog posts and team News featured below. If you missed any of our newsletters or monthly investment commentary, be sure to check out our Newsletters & White Papers page for the latest market news and articles to educate and inspire.

Barks N’ Rec for Saint Francis Service Dogs

Do you run? Bike? Kayak? Can you juggle? Cartwheel? Are you great at hacky sack? Whatever you like to do for fun, do it for Saint Francis Service Dogs.

What SVB’s Collapse Means for Your Money

The good news is that most investors don’t need to be concerned.

What Is Financial Life Planning and What It Means to us at PIFP

Financial Life Planning might be a new term for you. We're sharing why we choose to approach wealth management from this unique angle.

7 Excellent Ways Gen X Can Level Up Their Money

As you continue thinking about ways to optimize your wealth before retirement, here are seven ways Gen Xers can do to level up their money.

4 Great Tax Planning Secrets High Earners Need to Know About

One of the key ways to preserve wealth is to take control of your tax liability year after year. Our tax planning secrets can help you!

How to Find the Right Financial Advisor in Charleston, SC for You

Looking for a Financial Advisor in Charleston? At first, it may seem like all advisors are created equal, but, there are many differentiators.

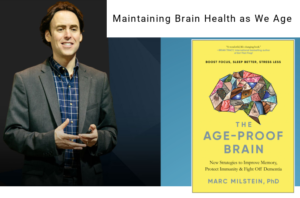

Dr. Marc Milstein Virtual Presentation “The Age-Proof Brain”

Maintaining Brain Health as We Age - Virtual Event Organized by PIFP